Economic Indicators

During the pre-market Trading Activities session, economic indicators are some of the most important factors that affect price behavior. Most significant economic reports are published at 8:30 a.m. Eastern Standard Time, one hour before the New York stock market starts trading. These indices are used to measure the performance of the stock market. Because they are traded almost around the clock.

The gross domestic product (GDP), weekly unemployment claims, and retail sales are among important figures announced around 8:30 a.m. Eastern Standard Time and potentially move markets. You will have a better understanding of the behavior of the market if you look at the analyst forecasts for these statistics. Most of the time, the market's most significant movements occur when the actual number significantly exceeds or falls short of the forecasted amount. This generates high volatility, which in turn presents trading risks and possibilities.

Earnings Announcements

The period when publicly listed corporations publish their quarterly earnings reports is called "earnings season." The beginning of the earnings season typically occurs one to two weeks following the conclusion of each fiscal quarter. As a consequence of this, the majority of corporations report their results from the beginning to the middle of January, April, July, and October. During this period, business results are often announced before and after the market closes. This may frequently cause big price changes in the underlying equities outside normal trading hours. During this time, the market is closed.

Major News Events

After normal trading hours or over the weekend, the news and announcements of significant geopolitical events are often broadcast in the media, which can cause enormous market movements. Unanticipated occurrences such as wars and natural catastrophes are examples of the kinds of things that have the potential to catch the market off guard at any moment. Access to the market before it officially opens allows you to better position yourself and protect yourself from risk in unanticipated occurrences.

Trading Stocks on ECNs

Electronic communication networks, often called ECNs, are the trading platform that gives investors access to extended trading hours in the stock market. ECNs are electronic trading systems that automatically match buy and sell orders at defined prices. This enables individual traders and big brokerage companies to trade directly without needing a middle man like an exchange market maker.

When trading outside of the normal hours of the market, one thing to keep in mind is that the degree of liquidity is often substantially lower than during such hours. The difference in price between the bid and the offer is often quite a bit larger, and the "thin" level of trading may lead to more volatility. This comes with its own set of related dangers and possibilities.

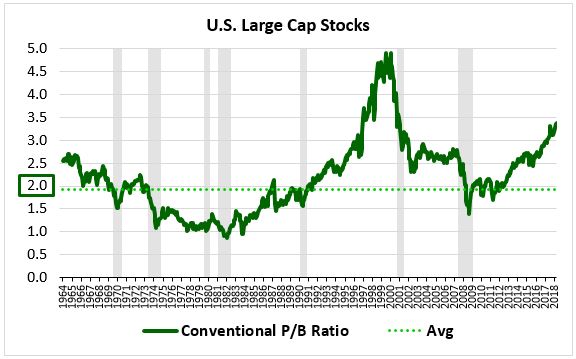

Future Market

During the pre-market session, careful attention is paid to the futures market. Futures contracts are standardized agreements to purchase or sell an item, such as a physical commodity or a financial instrument, at a fixed future date and price. These agreements may be made to buy or sell futures contracts. These indices are used to measure the performance of the stock market. Because they are traded almost around the clock. S&P 500 futures are often used by money managers for either hedging risk over a certain period by selling the contract short or increasing their exposure to the stock market via the purchase of the futures contract.

E-mini S&P 500 futures has several advantages, one of which is the high degree of liquidity. This advantage comes from traders having access to the market for practically the whole day. The difference between the highest and lowest bids or offers is rarely very large. The spread may be considered an initial investment required to enter the market. Getting spreads as narrow as possible is essential since the greater the spread, the farther the transaction must go in your favor before you can even consider yourself. As a consequence of this, the majority of corporations report their results from the beginning to the middle of January, April, July, and October. During this period, business results are often announced before and after the market closes.