Significance For Investors

According to an analysis done by an NYU professor, Aswath Damodaran, S&P data reveals that the rise in corporate earnings for the four years leading up to 2018 was 36%. However, on a year-over-year basis, S&P 500 earnings were down in the first two quarters of 2019, and according to FactSet Research Systems, profits are anticipated to be lower by 3.7% in the third quarter of 2019. The current consensus forecast is for a growth of 3.2% for the fourth quarter of 2019 and a modest gain of 1.3% for 2019.

The statistics provided by the government indicate that the consensus projections, which are derived from the data provided by S&P, may likewise be too optimistic. Edwards refutes this by stating, "In sharp contrast to growing stock market estimates of profits, the BEA's NIPA have flatlined for the previous three years." This start date is pushed back to 1871 thanks to the integrated equity technique, which enables us to investigate a period of market history that would have been inaccessible to us otherwise. He is referring to the statistics compiled by the United States Bureau of Economic Analysis called the National Income and Product Accounts (NIPA) (BEA).

According to the BEA, one of the most significant distinctions between the data provided by S&P and NIPA is that the latter has a far wider reach since it also considers private firms and S corporations. As a result, the data may differ from the profits reported by public companies in the S&P database that use generally accepted accounting principles (GAAP). There are also additional distinctions, the most notable of which is that the NIPA data makes an effort to account for revenues derived from ongoing production.

NIPA data

According to MarketWatch, one of the primary reasons Edwards favors the NIPA data is derived from tax returns filed to the IRS. This is a very important factor. For instance, private firms do not have any motive to exaggerate the number of their taxable earnings. Still, public corporations have such an incentive because they must publish their profits to the general public to attract investors. He also suggests that earnings at private enterprises that are smaller and more focused on the local market may be a better sign of the route the economy of the United States would go.

The fact that the NIPA corporate profit statistics for 1Q 2019 experienced a decline of approximately 10% from the original estimate to the final amount lends credence to Edwards' dismal outlook on the trajectory of the U.S. economy. "The most recent adjustments to U.S. whole economy profits, also known as profits from the National Income and Product Account, were sufficiently significant to imply that the conclusion of this record economic cycle is far closer than was previously assumed, " "According to MW, he notes.

Advantages

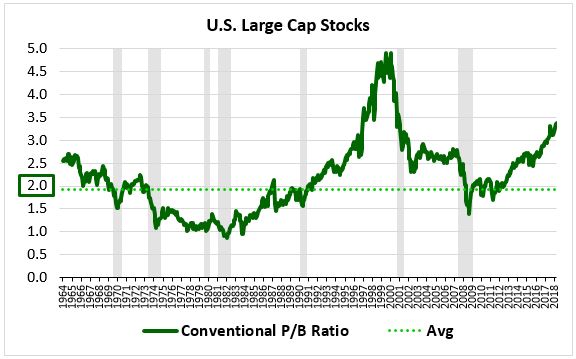

One of the most significant benefits of the integrated equity technique is that users are not required to access information on reported book value. It does its book values calculation, beginning from scratch. Earnings and dividends are the only two things it needs as inputs to complete the computation. As a result, it is possible to create historical profitability data back to January 1871, which was the first month for which profits and dividend information was accessible for U.S. equities:

In the late 1920s, official statistics on the profitability of American firms first became available. This start date is pushed back to 1871 thanks to the integrated equity technique, which enables us to investigate a period of market history that would have been inaccessible to us otherwise.

Looking Ahead

According to Edwards, at this stage of the aging economic cycle, profits and profit margins for the entire economy take a nosedive. In the middle of subsequent recessions, Edwards says that this is when whole economy profits and profit margins take a nosedive. "Edwards is quoted as saying, "when corporations dismiss their CEOs and write off years of overstated profit growth in one single sweep," and MW reports that this is exactly what happens. For instance, private firms do not have any motive to exaggerate the number of their taxable earnings. If the analyst is correct, investors should prepare for more significant drops in their profits.